Follow Up on Alhambra Grant Continue Work on Gala Especially Auction

Returning to the theme of the parallel evolutionary developments in the early 20th century as compared to the last decades of it, in 1908 famed Gilded Age industrialist Andrew Carnegie wrote what seems today a misplaced article for New York Outlook magazine. The steel magnate lamented the state of American banking, which he called within his piece "at least one humiliation to lessen self-glorification."

The purpose of his writing was in support of gold. That's what seems out of place to our "modern" senses, for the US was by then restored to the fullest gold standard. The constant silver agitation of the later 1800's had been put to the past twelve years before Carnegie's article. Bimetallism had been settled in favor of the gold, so what possible of its virtues was left to extol?

Men have railed against gold as if it had received some adventitious advantage over other articles. Not so; gold has made itself the standard of value for the same reason that the North Star is made the North Star-it is the nearest star to the true north, around which the solar system revolves. It wanders less from, and remains nearer to the center than any other object. It changes its position less. To object to gold as the standard of value, therefore, is as if we were to refuse to call the star nearest of all stars to the true north, the North Star.

The problem was instead currency rather than money. In those days this was not a distinction of semantics. US banks had been limited in their currency issues by the remnants of Civil War finance. In other words, a bank was constrained by the amount of, among other things, government debt on its books. It was a way in the 1860's to help pay for war while also ensuring, in theory, bank currency backed by solid and the most liquid instruments.

Carnegie's 1908 criticism was in response to the Panic of 1907. It was his point that banks should be relatively more free to issue currency because they held substantial reserves in gold unrelated to government debt. And by its very nature, the North Star of finance, that should count for at least something, especially during periods where currency could be somewhat helpfully elastic.

From the perspective of banks operating upon federal debt reserves, the government had the foul habit of paying down debt and running deficits only during declared conflagrations. Before the Fed, the Treasury Department had learned in the late 19th century by accident its action could have great monetary consequences. It exercised these powers very rarely, and did not during the 1907 event; thus, Carnegie's lament and what would become a few years later the Federal Reserve.

In the 21st century, obviously, there isn't anywhere near the same level of cause and effect, but there is some. It is in the current age a currency derivative where these relationships matter most, meaning not in specifically currency terms but in places like repo collateral (which can often act like currency).

We tend to notice these things nowadays during drama like the various debt ceiling arguments. The "will they or won't they" about the politics of it creates uncertainty which only raises risks. This year has already witnessed one such episode. In March, the 18-month prior moratorium ended, creating a new debt ceiling at that level of debt. The US Treasury has since then been using various accounting tricks to stay below.

In May, Treasury warned that it may run out of discretion as early as summer. With that time fast approaching, investors have begun to think through implications.

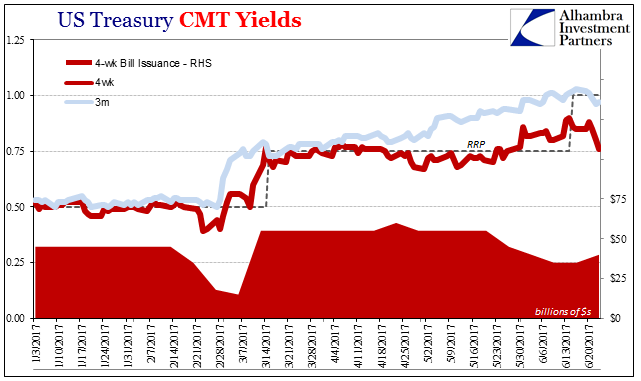

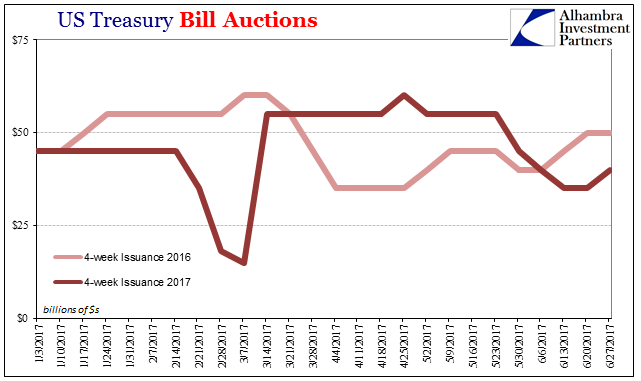

The auction of bills, for example, has been scaled back at each quarter end so far in order to reduce the debt footprint. We do need to keep in mind bill supply as much as potential demand when analyzing the mechanics of this vital piece of money markets (and not just collateral, but also cash equivalence). As you can see above, there does appear to have been some relationship between supply and the fall in yield below the RRP in late February.

It doesn't, however, hold for much more than that. When bill rates dropped again below the RRP "floor" in mid-April, they did so with bill supply significantly heavier than at the same time last year.

And when Treasury began scaling back the regular 4-week auction size toward the end of May, the equivalent yield actually rose at the same time. It wasn't until just recently that the 4-week level dropped precipitously, while Treasury issuance for the 28-day instrument is already on its way back up again.

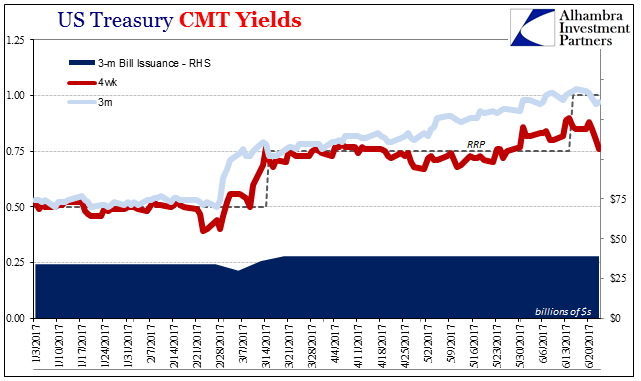

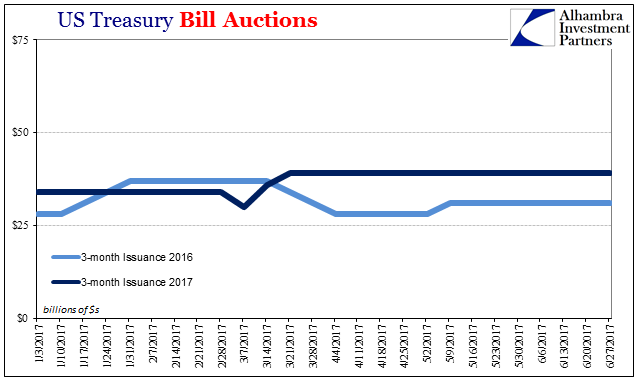

Further, auction levels in the 3-month security haven't much changed at all. The recent participation of 3-month yields below the RRP "floor" have happened while issued amounts remain substantiallymore than at the same time in 2016.

It is possible that institutions are hoarding 3-month bills ahead of any debt ceiling difficulties this coming summer, but that wouldn't account for the more glaring error in the 4-week instrument; the latest CUSIP (912796LL1 ) being sold tomorrow is maturing on July 27, several weeks before the latest estimates for debt ceiling maneuvering room is thought to be exhausted.

We do have to be sensitive to these sorts of supply issues because as opposed to the pre-crisis era the private monetary system no longer supplies its own low risk (low haircut) collateral. Gone are the days when any form (prime or subprime) of MBS (GSE or private label) could be accepted and rehypothecated easily and on the best terms. Systemic collateral shortage is a major element of eurodollar decay, and has been for the whole last decade.

In this case, however, there doesn't appear to be a direct supply issue restraining collateral flow – at least not one that would propose the dramatic and, for the Fed, embarrassing money market discrepancy produced by the 4-week bill rate. Liquidity preferences are almost certainly being exposed by something else.

Source: https://alhambrapartners.com/2017/06/26/follow-up-on-bills-supply-side/

0 Response to "Follow Up on Alhambra Grant Continue Work on Gala Especially Auction"

Post a Comment